Michael (33) is a consultant for an engineering firm in the suburbs of Chicago earning $225K annually — though his salary was cut to $160K for 2021 due to COVID-19. He and his wife Sarah have four children ranging from ages 2 to 12. They are primarily concerned with protecting against Michael’s premature death, saving for their children’s education and weddings, and building up a portfolio for their own retirement at Michael’s age 62. Their Fall 2021 balance sheet and baseline cash flow projections are displayed below:

Balance Sheet

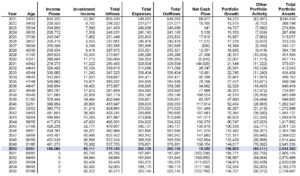

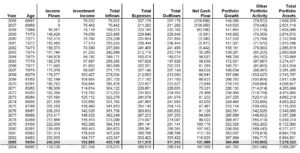

Cash Flow Page 1

Cash Flow Page 2

They have been heavily researching various options, but are struggling to decide on the optimal life insurance structure, investment plan, and distribution strategy. As such, they proceed to thoroughly analyze each issue through a combination of quantitative and qualitative analysis.

Preliminary Financial Plan

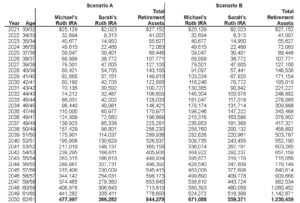

Scenario A Summary

- Purchase whole life insurance policy with $2.7 million death benefit

- Start funding Roth IRAs now, fund a 529 education plan for 4th child once cash flow is positive, and contribute any excess cash flow to brokerage

- Invest accounts 75% stocks and 25% bonds overall, excluding insurance cash value

- Utilize brokerage and Roth IRA accounts as needed to fund most pre-retirement expenses, 529 plan for 4th child’s college expenses, life insurance cash value for weddings, brokerage and life insurance cash value for early retirement expenses, Roth IRAs for late retirement expenses

Scenario B Summary

- Purchase 30-year term life insurance policy with $2.7 million death benefit

- Start funding Roth IRAs and 529s for all children now, and contribute any excess cash flow to brokerage

- Invest accounts 75% stocks and 25% bonds overall

- Utilize brokerage account as needed to fund most pre-retirement expenses, 529 plans for all children’s college expenses, brokerage for early retirement expenses, Roth IRAs for late retirement expenses

Scenario A Detail

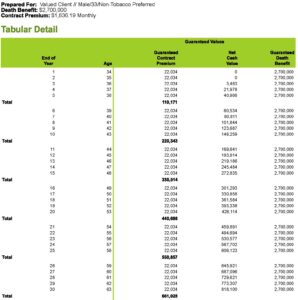

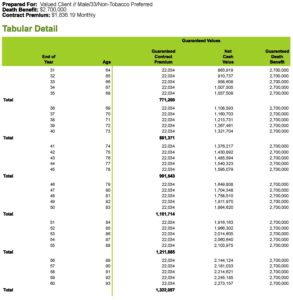

Michael and Sarah have read all about the benefits of whole life insurance including the fact that the death benefit remains in place throughout the insured’s lifetime and that the cash value of the policy grows tax-deferred with no market risk. They are concerned about what would happen to their family should Michael die after the typical 30-year term offered by temporary life insurance as well the impact that an uncertain economic landscape could have on a traditional stock/bond portfolio. Lastly, they think it would be helpful to avoid the ongoing interest, dividend, and capital gains taxes such a portfolio would yield. As such, they have obtained the illustration below from a well-regarded insurance company to incorporate into their financial planning model:

Whole Life Illustration Page 1

Whole Life Illustration Page 2

The above proposal not only provides for a death benefit that would cover all of their future expenses, but also offers cash value accumulation with some very attractive return characteristics. Specifically, the long-term after-tax rate of return on the net premiums — the excess premiums paid over those of a term policy with an equivalent death benefit — comes to about 2.5% on a guaranteed basis. In an environment where yields on corporate bonds hover around 2% subject to current income taxes and various elements of risk, this seems like a very solid portfolio alternative. While remitting over $1,800/month for this policy would undoubtedly put additional strain on their already shaky short-term cash flow, they note that their brokerage account has a high tax basis and would be an efficient resource for funding any shortfalls for the foreseeable future.

In fact, they would also plan to use the brokerage account to fund $12K annual Roth IRA contributions until their cash flow turns positive. They figure that it would be worth paying some taxes up front to get the cash needed for these contributions in order to facilitate long-term tax-free investment growth. While they are currently ineligible for direct Roth contributions because their income level exceeds the relevant threshold, they have heard from several reputable sources that they can contribute indirectly by first funding Traditional IRAs and transferring these deposits to Roth IRAs shortly thereafter. Although they would likely come to rely on these Roth accounts to cover expenses in the near future, these distributions would not be subject to taxes or penalties because they would never exceed the cumulative amount of contributions made ($18K as of today).

Should they attempt to start saving for college as well over the next several years, however, and further deplete their brokerage via 529 plan contributions, they would eventually be forced to draw upon the investment earnings in either the 529s or Roth IRAs for non-qualified expenses which would incur taxes and potentially a 10% penalty on the earnings distributed. As such, they only plan to formally fund a college savings plan for their youngest child who will still be in high school when they expect to have the cash flow needed to support contributions. While this 529 plan would only have a few years to grow tax-free, Michael and Sarah would also be eligible for a college savings deduction on their Illinois tax return worth about $1K for each year in which they contribute. Having utilized all of the tax-advantaged savings available to them, they would contribute any additional excess cash flow going forward to their taxable brokerage account for retirement.

Michael and Sarah have also heard that the optimal way to determine the appropriate equity component of a portfolio allocation is to subtract your age from 100. While this would suggest a 67% stock/33% bond allocation, they would view the contractually guaranteed nature of the life insurance cash value as an essential diversifier that would grow over time and believe that a 75/25 portfolio excluding the policy would be prudent. The 75/25 portfolio would have an expected annual return of 6.3%, with a standard deviation of 12.6%.

Due to the considerable life insurance premiums, they would need to heavily supplement their income with investment assets to pay for both everyday and intermittent expenses. To cover most of these shortfalls especially in the early years, they plan to use the brokerage account and the Roth to the extent necessary to avoid reducing the life insurance death benefit or its guaranteed tax-deferred growth. They would only plan to touch the cash value for their children’s weddings and as a source of income early in retirement to supplement brokerage distributions and Social Security. The balance of the Roth IRAs would be earmarked for the later years of the plan to prolong tax-free growth.

Scenario B Detail

They are also considering the possibility that their retirement time horizon is too long to justify having such a large portion of their assets invested in a conservative policy even if they are getting a relatively attractive risk-adjusted after-tax return. 2.5% guaranteed might be better than any high quality taxable bond could achieve, but could additional stock exposure in other tax-advantaged accounts offer more without creating too much downside risk? Furthermore, they are deliberating over their need for permanent insurance protection. Perhaps if something were to happen to Michael after say 30 years, his death would be less financially significant given that they would have already paid for many expenses and accumulated the assets needed to fund the balance. To help analyze these issues, they also requested quotes for a 30-year term policy from a company with a similar financial rating to that of the whole life provider which came back at $3,700/year — over $18K less than the annual whole life outlay.

This additional annual cash flow would not only better preserve the Roth accounts as outlined in the report below, but also allow the couple to formally fund each child’s college education with 529 contributions without the fear of needing to take non-qualified distributions down the road. They would spread out these contributions over several years rather than funding most of them up front to avoid the need to sell additional taxable assets and earn as many annual Illinois tax deductions as possible.

Roth IRA Asset Report

The spenddown strategy in this scenario would be far simpler than that of Scenario A. The brokerage would be used for all pre-retirement expenses other than college which would be fully funded by the 529 plans, and the balance of the brokerage would be used first in retirement followed by the Roth accounts.

Analysis

To determine the superior strategy, Michael and Sarah use financial planning software to perform a Monte Carlo analysis on both scenarios — stress tested for additional unexpected expenses in retirement. By running 1000 simulations of each strategy, they can observe the distribution of outcomes that could occur based on assumptions about the variability of expected portfolio returns and inflation. They know that the Scenario B results might be unattractive in the short-run because it reallocates money from the guaranteed returns of an insurance policy into the volatile stock market and will have yet to showcase its enhanced tax-free accumulation, but would their short-term goals actually be in danger? Which option would provide for a more comfortable retirement? Let’s take a look at the Asset Spread reports below to find out.

Asset Spread – Scenario A

Asset Spread – Scenario B

The bands above depict the pattern of portfolio results over time for each strategy in present value. By displaying the 50th, 80th, and 20th percentile trials, it captures the median outcome as well as the upside and downside potential of each strategy. The top of the light blue shaded area represents a market simulation that was particularly favorable, while the bottom of the dark blue captures a future with lower returns and/or higher inflation. The bolded line in the middle assumes moderate results.

Despite the increased risk undertaken in Scenario B, they conclude that their chances of depleting their portfolio in the early years of the plan would remain extremely low with only a 20% chance of dropping below $140K at any point over the first 15 years. In the long-run, Scenario B clearly offers a superior distribution of results characterized by almost $1.25 million of increased upside potential, an additional nine years of funding assuming moderate returns, and a slightly improved downside.

While they may have confirmed that term insurance would help to facilitate optimal results assuming they both live for a long time, they still need to determine if this plan would be viable in the event that Michael were to pass away after the term expires at his age 63. If not, they would clearly need to move forward with a more permanent policy.

As it turns out, even if Michael were to die immediately after the term insurance expires at his age 64, the family would maintain a very healthy financial trajectory. This is because Sarah would be eligible to collect Michael’s higher Social Security benefits as a widow, and would also be able to cut spending by about $15K/year if living by herself. Given that Michael was not planning on saving past 63 in the first place, their projected starting retirement portfolio value of close to $3 million would not be harmed in any way. In fact, the unrealized capital gains in their brokerage account as of the date of death would be sliced in half due to a concept called a step-up in basis.

Satisfied with the insurance protection provided by the term policy, they decide to rule out Scenario A as an option.

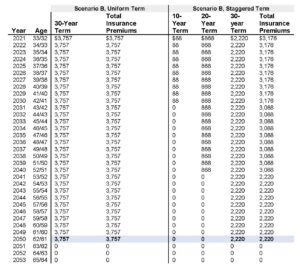

Scenario B Optimization – Life Insurance

Now that they have decided on a preliminary approach, they seek to optimize each facet through additional sensitivity analysis. The first aspect they wish to refine is the term life insurance structure.

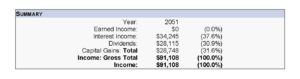

Summary

Preliminary Strategy: Purchase 30-year term life insurance policy with $2.7 million death benefit

Alternative Strategy: Purchase 10, 20, and 30-year term policies with $2.7 million combined death benefit

Analysis

The $2.7 million coverage amount was determined by calculating the present value of all of their future liabilities and offsetting that figure with the value of their current liquid assets. While they recognize that this gap is expected to close over time, they have assumed to this point that the amount they would save in premiums by progressively reducing their coverage throughout Michael’s working years would not be enough to justify the increased risk exposure.

To explore this further, they have also obtained quotes for 10, 20, and 30-year term policies with face amounts of $200K, $1 million, and $1.5 million respectively. For the first 10 years — during which time Michael’s death would be most financially significant — they would have the full $2.7 million of protection. After year 10, the small policy would expire and their coverage would remain at $2.5 million for the next 10 years. At that point, the 20-year policy would drop off leaving only the $1.5 million contract until Michael’s retirement. They wish to determine if the premium savings associated with this structure would make a substantial impact on their plan and if employing it would create too significant a risk exposure.

Due to the reduced premiums displayed in the report below, their median portfolio projection suggests that they would gain almost $70K (in today’s dollars) over time with the staggered policy design. The long-term impact would exceed the nominal premium savings due to the time value and tax savings associated with expediting 529 plan contributions with the additional liquidity. Instead of needing to wait until 2032 to start funding the second to last college savings plan, they could commence $2K in annual funding for the next 11 years without touching any IRA assets — which would not only expedite tax-free compounding, but also increase their Illinois tax deductions.

They also find that their assets and insurance proceeds would always exceed the present value of their future expenses regardless of when Michael’s death might occur. As such, they decide to move forward with this approach.

Insurance Premiums

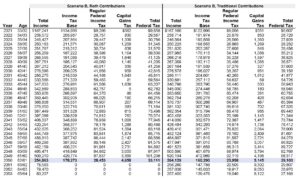

Scenario B Optimization – Roth vs. Traditional IRA

Summary

Preliminary Strategy: Start funding Roth IRAs now

Alternative Strategy: Start funding Traditional IRAs now

Analysis

Michael and Sarah’s decision to start saving for retirement now is not coming from a place of discipline, but rather planning acumen. They recognize that the annual returns generated by the Roth IRAs would not only exceed that of the brokerage account due to their exemption from portfolio income taxes, but would also compound indefinitely. While the 529 plans might also cultivate tax-free returns, they would only do so until their children graduate from college. Given the superior long-term accumulation capacity of the IRAs, sacrificing current contributions to expedite college savings would ultimately reduce their probability of success.

They are also aware of their eligibility to utilize Traditional IRAs instead and earn tax deductions equal to their annual contributions in lieu of tax-free account growth, but have been hesitant to consider this alternative for several reasons. For one, they know that current tax rates are historically low and that the United States is running a large budget deficit. To the extent that rates rise in the future, tax-free Roth distributions down the road would be relatively more valuable than getting tax deductions today. Furthermore, they have read that their Traditional IRAs would be subject to Required Minimum Distributions (RMDs) once they each turn 72. Given that these distributions would be fully subject to ordinary income taxes, they are concerned that this mandate would force them into high tax brackets in retirement, cause their Social Security benefits to become taxable, expose their retirement portfolio to the 3.8% surtax on investment income, and subject their Medicare premiums to the infamous IRMAA surcharge. Upon further review however, they realize that this analysis is both flawed and incomplete.

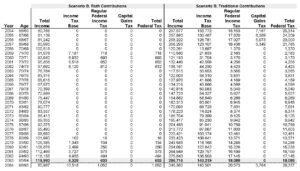

The projection below captures their federal income tax trajectory over time for both Roth and Traditional IRA contribution scenarios assuming that the tax reform instituted by the Trump administration sunsets in 2026 and all rates revert back to their higher, pre-2017 levels. As expected, their income levels and associated liabilities in the Roth scenario are high in the early years and more moderate in retirement, while the opposite is true for the Traditional scenario. The question is — which cumulative tax burden is greater from a time-value of money perspective and why?

Federal Income Tax – Page 1

Federal Income Tax – Page 2

As it turns out, the Traditional strategy is projected to outperform the Roth approach by almost $125K in present value by enabling them to more efficiently navigate tax brackets as well as further enhance 529 accumulation and deductions.

In their original analysis, Michael and Sarah assumed that they would commence Traditional IRA distributions only once required to defer taxes as long as possible. Not only would this deemed annual income of roughly $70K+ be recognized at a rate of 15%, but it would also increase the portion of their $150K of Social Security which would be subject to taxation from $60K to $120K due to a complex IRS convention. Thus, the effective tax rate on these distributions would be closer to 30% — higher than their brackets during the contribution years which would range from 24-28%. Not to mention the impact that these RMDs would have on the aforementioned surcharges.

What they failed to consider was the impact of Roth conversions of $160K annually during the seven year period spanning from Michael’s first year of retirement through his age 69. By moving assets from their respective IRAs into Roth IRAs, they would incur taxes on the amount transferred up front in exchange for tax-free distributions later. Given their minimal projected income during this period as illustrated in the exhibit below for the first year of retirement, a large portion of these conversions would be taxed at rates of 0-10%, with the balance recognized at 15%. Given that they only plan to start Social Security at Michael’s age 70, the effective rate on these conversions would in fact remain below 15%. Furthermore, the depletion of their Traditional IRAs from over $1 million combined to less than $320K during this period would significantly curtail their RMDs and associated gross income for the duration of retirement. Thus, their Social Security income would remain almost 50% tax-free and they would never be assessed any portfolio income or Medicare premium surcharges which currently kick in at over $250K and $176K of AGI respectively — the latter threshold indexed for inflation.

2051 Income

A secondary reason why the Traditional scenario outperforms is that it would further expedite 529 plan contributions. Specifically, they could add the $3K annual tax savings achieved via the IRA deductions to the $2K already being allocated to their third child’s plan which would yield additional tax-free portfolio growth and shave another $150/year off of their Illinois tax bill.

Not only is the Traditional IRA strategy clearly the more favorable option — it may also turn out to be the only legal one. As Michael and Sarah were finalizing their financial plan in late 2021, the House of Representatives proposed a number of changes to the tax code as part of the Build Back Better plan including the elimination of the indirect or “backdoor” Roth contribution — the only mechanism by which they could overcome the Roth IRA annual income limitations. While at the moment it seems unlikely that this particular bill will pass as currently written, the fact that this loophole is getting bipartisan attention in Congress would make it somewhat imprudent to rely on its long-term viability. Given this additional constraint, the couple settles on the idea of using their Traditional IRAs to save for retirement for the foreseeable future.

Note: It is worth mentioning that the reduction in AGI associated with annual Traditional IRA tax deductions would not have a significant impact on income-related child tax benefits such as the Child Tax Credit or the Child and Dependent Care Tax Credit. While dropping their AGI from $163k to $151k could help preserve close to $1k of these credits for 2021, dropping it from $235k to $223k in future years would have no marginal impact even if the recent increase in the amount of these credits is extended via tax legislation.

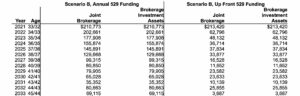

Scenario B Optimization – Annual vs. Up Front 529 Funding

Summary

Preliminary Strategy: Spread contributions over time to limit gains and increase IL deductions

Alternative Strategy: Maximize contributions up front to start tax-free compounding

Analysis

To this point, they have assumed that while funding the 529 plans as much as possible up front would reduce their portfolio taxes most extensively, these savings would be overridden by the combination of expedited capital gains taxes on the brokerage assets sold to make these contributions and the loss of ongoing Illinois tax deductions which are applied to a maximum of $20K in contributions per year. To test this hypothesis, they compare the existing plan to one in which they fund the three older children’s college expenses in full in 2022. Any expedited contributions towards the youngest child’s plan would eventually force them to reach into the 529s or IRAs prematurely and incur ordinary income taxes and possibly a 10% penalty for doing so.

As it turns out, this alternative plan would in fact deliver an additional $5K in long-term value — further demonstrating the supremacy of federal ordinary income tax avoidance over capital gain or state tax mitigation. Nevertheless, they decide against this idea in the name of flexibility. While it may be prudent to fund the 529 plans over the course of several years while they observe each respective child’s development, depleting their only source of penalty-free withdrawals at the pace depicted below while their children are young and their portfolio limited would be irresponsible in their view.

Brokerage Account

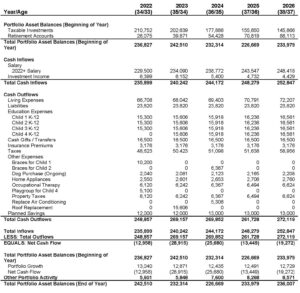

Conclusion

To better understand their plan in the short term, they take note of their projected cash flow over the next five years including their income, expenses, 529 contributions (Cash Gifts and Transfers), IRA contributions (Planned Saving), and overall Net Cash Flow. While this cash flow appears to be negative, they recognize that the Cash Outflows section includes the planned funding of the IRAs and 529 plans and do not represent actual expenses. While the IRA contributions are included in Other Portfolio Activity (as offset by Investment Income) and are thus reflected in the yearly Portfolio Asset Balances, their 529 balances are separately accounted for.

Five-Year Cash Flow

Satisfied with their planning strategy, they complete the administrative steps necessary to put it into place including:

- Fulfilling the underwriting requirements of the insurance company

- Opening up Traditional IRAs for the two of them and 529 plans for all four children with reputable custodians

- Setting up links between these institutions and their bank to transfer funds back and forth electronically

- Contributing the appropriate amount to each account on an annual basis

- Selecting low-cost, diversified investment funds and optimizing the allocation of these funds across their accounts

- Engaging an accountant or utilizing tax software to ensure they comply with tax reporting and payment requirements

They plan to revisit this plan over time as the economic and legislative environment evolves or as their personal circumstances change. Until then, Michael and Sarah are confident that they have put themselves in the best position to succeed.