In our most recent article, The Bigger Picture: Current Events and the Informed Investor, we introduced the basic mechanics of market pricing and demonstrated the impact that a particular economic development might have on a portfolio both in the short-term and over time. Most notably, we differentiated between the ephemerality of dividend growth expectations, or g, and the more durable nature of the returns they are expected to yield over time, or E(r). While the latter has showcased significant volatility in 2022 due to historical levels of inflation, this pricing input tends to exhibit far more stability over time than any company income statement and thus represents the equilibrium of any financial plan. Thus, an investor seeking to understand the suitability and sustainability of a particular portfolio must ascertain both the variability of its growth outlook and associated price fluctuations as well as its more homeostatic expected return.

As noted in previous publications, such portfolio characteristics are derived from the expected return, standard deviation, and correlation assumptions of its underlying asset classes. While financial institutions might share similar views on many of these parameters, their unique methodologies often yield divergent results. It is therefore critical that the informed investor employ assumptions that are not only consistent with research, but also compatible with the planning framework they intend to utilize.

Treasury Bonds

Treasury notes, bills, bonds, and other securities represent the most secure investments on the market. Given the capacity of the Treasury to tax the wealthiest nation in the world to fund its principal and interest obligations, these securities are not subject to default and therefore attract investors despite offering minimal yields. These “risk-free” rates vary with prevailing monetary policy as well as the structure of a given bond.

Bonds at the “short-end” of the yield curve i.e. those that will mature over the next few months or years, tend to offer returns commensurate with the rates available on alternative sources of short-term credit such as those offered by banking institutions. Given that these institutions often obtain loan capital from other Federal Reserve member banks or from the Fed itself, the APRs they set are a function of the “discount rate” — the most scrutinized metric on Wall Street today. As such, short-term government bond yields are simply a function of current Federal Reserve policy.

As an investor ventures out further along the yield curve however, bond pricing becomes more complex. If the alternative to purchasing a Treasury bill maturing in 10 years is to simply purchase 10, 1-year bills in succession, it stands to reason that the rate on the former would be derived from the latter. If an investor expects 1-year notes to yield 3% every year through 2031, why would they ever purchase a 10-year bill providing anything less? This parity dynamic forges a fundamental investing principle — that the collective opinion on the interest rates of tomorrow is reflected in the yield curve today. Well, at least to an extent.

The shape of the yield curve is also influenced by the term premium, or the compensation demanded by investors for taking on interest rate risk. While a long-term Treasury security may not be subject to default, that does not mean it cannot lose value. Take 2022 as an example. As expectations regarding the trajectory of monetary policy have risen in response to historically high inflation, investors have demanded higher semiannual payments from newly issued longer-term government bonds. Given that the prospective buyers of bonds already in circulation would miss out on these superior payments, they have lowered the price they are willing to pay for them. This explains why the Vanguard Intermediate-Term Treasury Index (VGIT) has lost over 6% this year despite the fact that the payments expected of the bonds it tracks have not changed by a penny.

It follows that the longer the duration of time until an existing bond is set to mature and can be reinvested into newer issues, the more sensitive its price will be to changes in interest rates. In exchange for this potential volatility, investors demand more from long-term bonds than successive short-term investments would yield. This term premium explains why the yield curve is often upward sloping even when the market expects fairly uniform monetary policy going forward.

Return: As of the start of 2022 when interest rates were considerably lower than they are today, Buckingham Strategic Wealth1 — whose annually updated long-term return assumptions best reflect the investing philosophy introduced in our prior publications — estimated short-term Treasury bonds to return 1.4% and intermediate-term issues to yield 2.6%. While there are a number of other institutions that publish portfolio projections, their 5 to 10-year outlooks are typically too short-sighted for big picture financial planning and are often tainted by controversial opinions on how current market narratives will play out.

Risk: To capture the possibility that interest rate expectations might change, Buckingham projected a standard deviation of 4.5% for short-term bonds and 5.3% for intermediate issues.

Correlation With Stocks: Unlike securities issued by private corporations, Treasuries are not impacted by changes in company profitability or solvency expectations. As such, their correlation coefficients with stocks were projected to range anywhere from -.1 to .1 depending on bond duration and stock category.

Corporate Bonds

As with Treasuries, bonds issued by private companies seeking to finance their operations offer fixed semiannual payments and are subject to price volatility on account of interest rate movements. Unlike their governmental counterparts however, corporate bonds are also subject to credit risk — or the likelihood that its issuing company will default on its payments. To help investors measure this probability, ratings agencies such as Moody’s, Fitch, and Standard & Poor’s segment corporate bond issuances into two categories — Investment Grade and High-Yield.

Investment Grade Bonds

Investment grade bonds refer to those issued by corporations with the healthiest balance sheets and steadiest income statements. In the event that such companies were to face economic adversity, they would likely have the liquid assets needed to meet their outstanding obligations. With a default probability of .1% in any given year, these investments tend to exhibit risk and return characteristics that only marginally exceed those of similarly structured Treasury bonds.

Return: 3.2%

Risk: 6.6%

Correlation With Stocks: .2 – .4

High-Yield Bonds

High-yield, or junk bonds on the other hand are sold by organizations with shakier financial ratios and higher rates of default. Investors in these securities are willing to take on this additional risk in exchange for more attractive yields.

Return: 4.9%

Risk: 14%

Correlation With Stocks: .5 – .7

Large-Cap Stocks

The most basic equity category on Wall Street, this asset class includes stocks issued by domestic companies with over $10 billion in market value. In exchange for direct exposure to the growth prospects of these corporations, investors demand returns which exceed that of any bond as defined by the CAPM.

Return: 7%

Risk: 17.4%

Correlation: In addition to moving independently of bonds, these investments also correlate imperfectly with other stock categories as detailed below.

International Stocks

As its name suggests, international stocks are those issued by companies headquartered in foreign countries. These securities are typically more volatile as their profits are denominated in fluctuating currencies and are often subject to unstable economic regulation. These additional systematic risks give rise to returns that are unachievable via domestic stocks alone.

Return: 8.8%

Risk: 21.1%

Correlation With Domestic Stocks: .45 – .65

The Three-Factor Model

While the CAPM provides a basic framework for understanding the relationship between stock risk and return, its lack of empirical support has given rise to a broader, more modern adaptation known as the Fama-French Three-Factor Model2. This framework suggests that there are two risk factors in addition to beta that help drive investment returns — size and value. Specifically, research has shown that all else equal, stocks issued by companies with less than $1 billion of market value i.e. small-cap stocks and those that trade at lower multiples of current earnings i.e. value stocks tend to generate superior returns over time than their larger, growth-oriented counterparts. Whether or not these factor premiums come along with additional risk is still a matter of academic debate.

Small-Cap Stocks

Return: 8.1%

Risk: 21.7%

Correlation With Large-Cap Stocks: .75 – .85

Value Stocks

Return: 8.2%

Risk: 17.1%

Correlation With Growth Stocks: .7 – .8

Real Estate

Both commercial and residential real estate play a key role in portfolio diversification. Whether an investor gains exposure to this asset class directly or via a fund structure, they can expect to earn healthy returns over time that are less sensitive to inflation and various other economic shocks.

Return: 8.1%

Risk: 18.3%

Correlation With Bonds: 0 – .4

Correlation with Stocks: .5 – .7

Other Assets

In addition to these more traditional categories, there are several other asset classes that can enhance portfolio efficiency including:

- Commodities

- Private Equity

- Business Development Companies

- Options and Futures

- Municipal Bonds

Each of these investments has unique properties that can either increase returns, decrease risk, or limit income taxes, and thus warrant consideration for many investors.

Portfolio Risk and Return

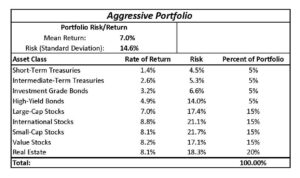

Per Portfolio Visualizer — an online investment optimization software — the inputs above yield an efficient frontier containing the following aggressive portfolio:

The above blend represents the highest yielding portfolio that can be achieved for the noted standard deviation assuming that every fixed income asset class must receive at least a 5% allocation, and that no equity category can represent less than 15%. Clearly, the software recognizes that real estate is the most attractive asset class due to its low correlation with both stocks and bonds.

In light of recent interest rate developments, an upward revision of the return estimates for each asset class and efficient portfolio would be prudent.

Inflation

To derive reasonable long-term inflation expectations, one can simply subtract the 20-year Treasury Inflation-Protected Bond (TIPS) yield from the 20-year Treasury Bond yield. As of July of 2022, this would indicate an inflation rate of 2.78% over time.

Setting Expectations

Once an investor has ascertained reasonable capital market assumptions, they can begin to develop expectations for their financial future by leveraging eMoney Advisor — a planning software program equipped with robust calculation engines capable of capturing the unique financial dynamics of any investor. While there are a number of other programs that offer similar functionality, none rival the analytical capacity or big picture perspective of the eMoney platform.

Of the myriad of inputs that impact the trajectory of an eMoney financial plan, the return characteristics assumed of its investments and the inflation rate applied to its expenses are among the most influential. Without the acumen needed to reject overly conservative assumptions or engage intelligently with Monte Carlo analysis and other stress tests, an investor will never discover their true financial potential. Note that unlike the behavioral properties of matter, the chemistry of informed investing is not an exact science. Given that the research on beta and other risk premiums is constantly evolving, even long-term, research-driven frameworks might produce return metrics that diverge somewhat from those we derived above. As such, the goal of an informed investor is to set reasonable expectations of their portfolio — not predict its exact yield.

Evaluating Results

The performance of an informed investment plan can be evaluated both with respect to its adherence to a specified benchmark as well as its tax efficiency. As market movements push asset class weightings away from their respective targets or when an investor needs to liquidate their portfolio for spending needs, tension can arise between maintaining efficiency and minimizing taxes. As detailed in Financial Planner vs. Investment Advisor: The Economics of Paying For Advice, Part Two however, there are a number of strategies that can be utilized to achieve the best of both worlds. To capture the execution of these tactics, an investor can review two metrics — one of which requires advanced software and the other a quick tax return review.

By uploading portfolio account activity along with the indexes it was mandated to follow into an analytics program, an investor can ascertain the percentage of its performance that was driven by risk factors underlying these indexes — or its R-Squared. On a scale from 0-1, this metric describes just how efficient a portfolio remained over a specified period of time.

Schedule D of an individual federal income tax return captures the costs an investor incurred in the process of maintaining a high R-Squared or perhaps pursuing alpha. Part I of this section details the gains recognized on investments held for less than a year, while Part II lists any long-term gains which are taxed at preferential rates. While there is no magic number in either section that could demonstrate prudent or imprudent tax management, short-term gains of any kind or long-term gains that comprise a significant percentage of the portfolio in question might warrant further review.

The Informed Investor

Over the course of our investing curriculum, we distinguished the value proposition of market outperformance from that of investment planning, outlined a framework for understanding market valuation and developments, and detailed the building blocks of research-driven portfolio construction and evaluation. We hope that the next time you are watching the news, sitting down with family and friends, or engaging a financial advisor, you will have the ability to participate in investing conversations more confidently than ever before.

References:

1 Buckingham Wealth Partners (2021). Asset Classes & Capital Market Assumptions.

2 K. French and E. Fama (1992). Common Risk Factors in the Returns on Stocks and Bonds. Journal of Financial Economics.